Living in Harmony with Earth

Perspectives

THE DUE DILIGENCE PROCESS

To identify new investment opportunities, evaluate deals, and manage oil and gas assets, we carry out the following process:

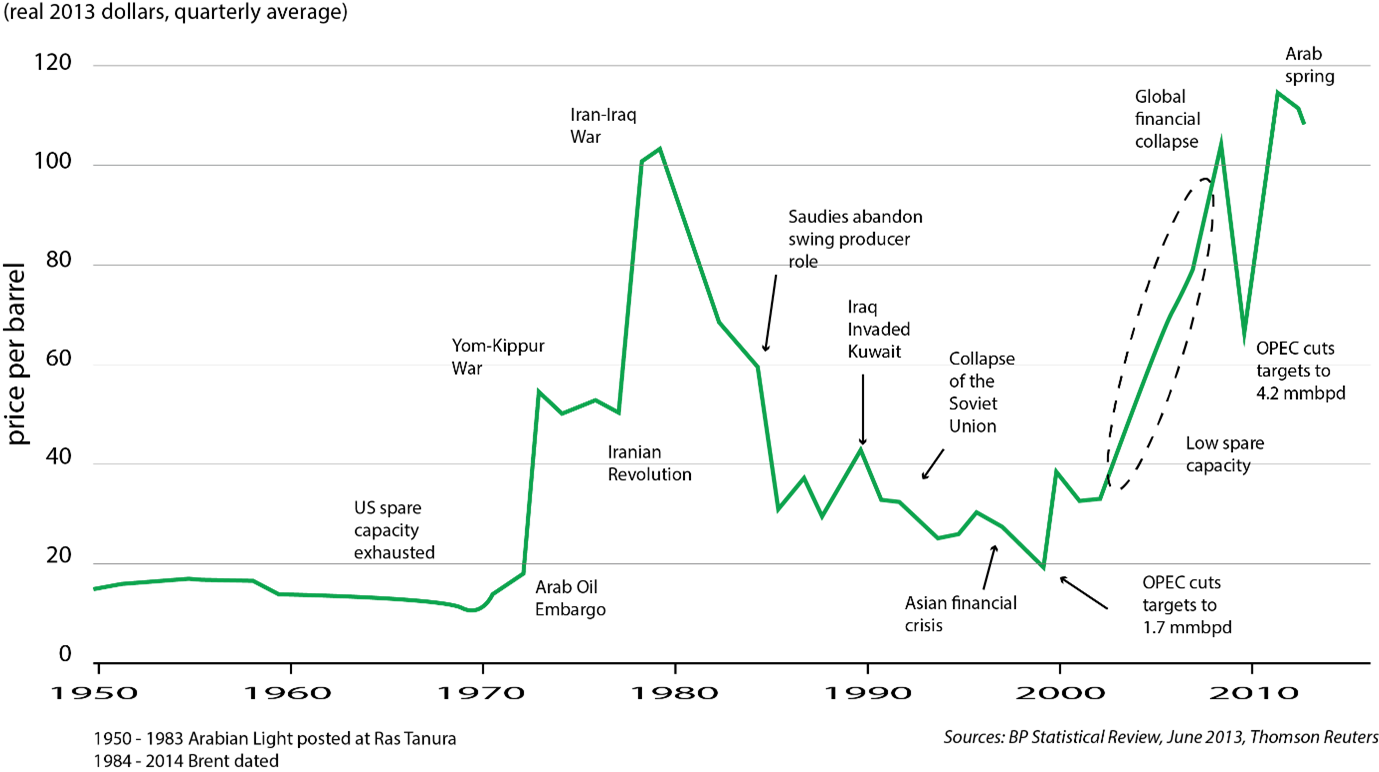

1. Analyse global geopolitical, macroeconomic, technologic, and weather trends. These trends have a big impact on the oil price which is the largest most important factors on the economics of petroleum project. During seventies to mid-eighties, wars and political events in the Middle East had a very strong impact in the oil price. For decades, world oil consumption was centred in the industrial countries of what was called the developed world. In the past ten years, globalization of demand, meant that only in China, petroleum consumption doubled, thus becoming the second largest oil consumer in the world behind the United States. Technology has a great impact too. We have seen in the very recent past how new seismic and drilling technologies have unlocked new frontiers such as the deep waters of the Gulf of Mexico, Brazil, and West Africa. The development of processing algorithms have made geoscientists see through more than a mile - thick of salt in the deep waters off Brazil. Now, after big successes in North America, the horizontal drilling and fracking technology is unlocking new frontiers in vast geographical areas such as those of China and Argentina. New frontiers are being unlocked as a result of global warming, too. In the Arctic, where more than 400 oil and gas fields have already been discovered onshore, the melting of the ice cap is opening new opportunities offshore. USGS estimates 90 billion barrels of oil in 33 provinces, 84% of which is expected to occur in offshore areas.

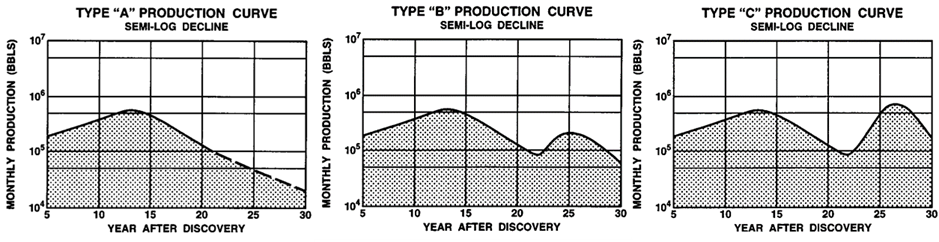

2. Evaluate what nature has provided in terms of total resource size that might exist under the ground as well as deliverability of the production and extraction facilities. First, the General Partner identifies marginally economic fields with large unrealized potential. We use publicly available data and analogue field studies to arrive at a value for the property, and make the owner an unsolicited offer. Potential field acquisition candidates can be identified using geological criteria or by production comparisons with analogue fields. We search for (i) economically marginal or near marginal fields with heterogeneous reservoirs that are interpreted as more homogenous and correlatable by the operator, and are composed of multiple stacked reservoir units that contain thin, continuous fluid flow barriers often below well log resolution, and; (ii) fields operated by companies with poorer production performance and lower profitability than other operators in the same trend or in adjacent fields. The more profitable and productive fields on trend become analogues for the fields of interest. Production performance from analogue fields guides selection of acquisition candidates. Often bids are based on extrapolation and interpretation of production decline curves as in the Type ‘A’ production curve (Figure 6). We look for acquisition candidates geologically similar to analogue fields that have production performance like Type ‘B’ and ‘C’. Production increases come from new wells in undrained reservoir compartments, infill wells, field extensions, workovers/recompletions, installing a waterflood or simply improving surface equipment, water quality and injection profiles in waterflood fields. The analogue production serves as a guide for bidding on the acquisition candidate.

3. Estimate the economic value of the project. Consistent with the PRMS, the calculation of a project’s NPV shall reflect the following information and data: (i) the production profiles (expected quantities of petroleum production projected over the identified time periods); (ii) the estimated costs [capital expenditures (CAPEX) and operating expenditures (OPEX)] associated with the project to develop, recover, and produce the quantities of petroleum production at its reference point, including environmental, abandonment and reclamation costs charged to the project, based on the evaluator’s view of the costs expected to apply in future periods; (iii) the estimated revenues from the quantities of production based on the evaluator’s view of the prices expected to apply to the respective commodities in future periods, including that portion of the costs and revenues accruing to the entity; (iv) future projected petroleum production and revenue-related taxes and royalties expected to be paid by the entity; (v) a project life that is limited to the period of entitlement or reasonable expectation thereof or to the project economic limit, and; (vi) the application of an appropriate discount rate that reasonably reflects the weighted average cost of capital or the minimum acceptable. According to the PRMS guidance, a project is generally considered to be economic if its best estimate (or 2P) case has a positive net present value under the organization’s standard discount rate.

4. Build a portfolio through diversification, discipline in risk management, and exit at the right time. Investment decisions are based on the General Partner’s view of future commercial conditions that may impact the development feasibility based on production and associated cash flow schedules of oil and gas projects. Commercial conditions reflect the assumptions made both for financial conditions (costs, prices, fiscal terms, taxes) and for other factors, such as marketing, legal, environment, social, and governmental. Meeting the ‘commercial conditions’ includes satisfying the following criteria defined in PRMS for classification as Reserves: (i) a reasonable assessment of the future economics of such production projects meeting defined investment and operating criteria, such as having a positive NPV at the stipulated hurdle discount rate; (ii) a reasonable expectation that there is a market for all or at least some sales quantities of production required to justify development; (iii) evidence that legal, contractual, environmental, and other social and economic concerns will allow for the actual implementation of the recovery project evaluated, and (iv) evidence to support a reasonable timetable for development.